SECURITIES AND EXCHANGE COMMISSION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x Filed by a Party other than the Registrant ¨ Check the appropriate box:

|

| | | | |

| | | | |

| ¨ | | Preliminary Proxy Statement |

| |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| x | | Definitive Proxy Statement |

| |

| ¨ | | Definitive Additional Materials |

| |

| ¨ | | Soliciting Material Pursuant to §240.14a-12 |

|

Alimera Sciences, Inc. |

| (Name of Registrant as Specified In Its Charter) |

|

|

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

|

| Payment of Filing Fee (Check the appropriate box): |

| |

| x | | No fee required. |

| |

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| | (1) | | Title of each class of securities to which transaction applies: |

| | | | |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | | | |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | | |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | | | |

| | (5) | | Total fee paid: |

| | |

| | | | |

|

| | | | |

| | | | |

| | | | |

| |

| ¨ | | Fee paid previously with preliminary materials. |

| |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | (1) | | |

| | | | |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | | | |

| | (3) | | |

| | | | |

| | (4) | | |

| | | | |

Alpharetta, Georgia 30005

NOTICE OF

A SPECIALANNUAL MEETING OF STOCKHOLDERS

TO BE HELD

SEPTEMBER 20, 2012JUNE 18, 2013

To the Stockholders of Alimera Sciences, Inc.:

You are cordially invited to attend a special

The annual meeting of stockholders

offor Alimera Sciences, Inc.

to(the “Company”) will be held at

our offices at 6120

WinwardWindward Parkway, Suite 290, Alpharetta, Georgia

30005, on

September 20, 2012Tuesday, June 18, 2013 at

11:009:30 a.m. local time.

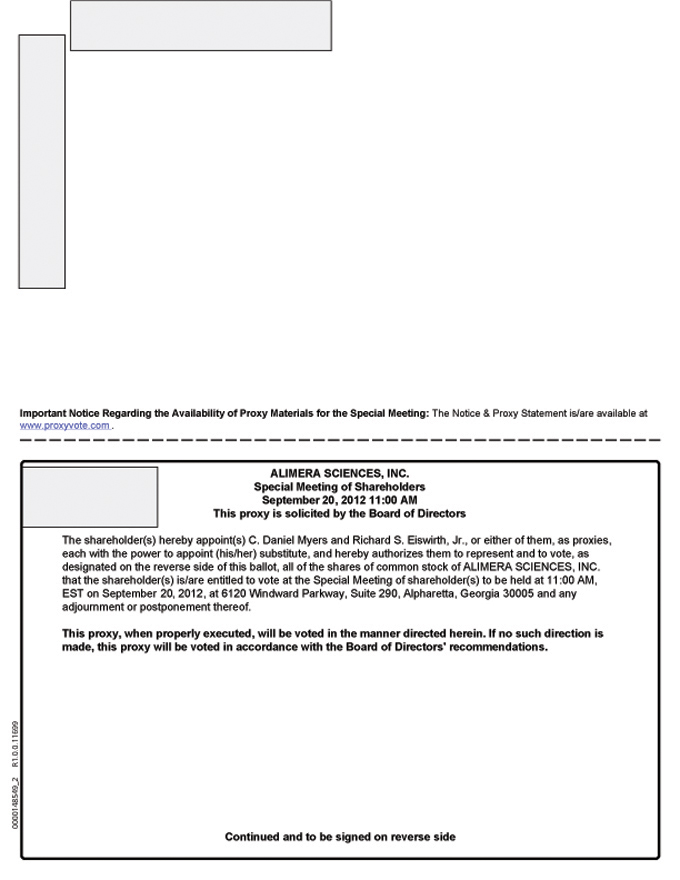

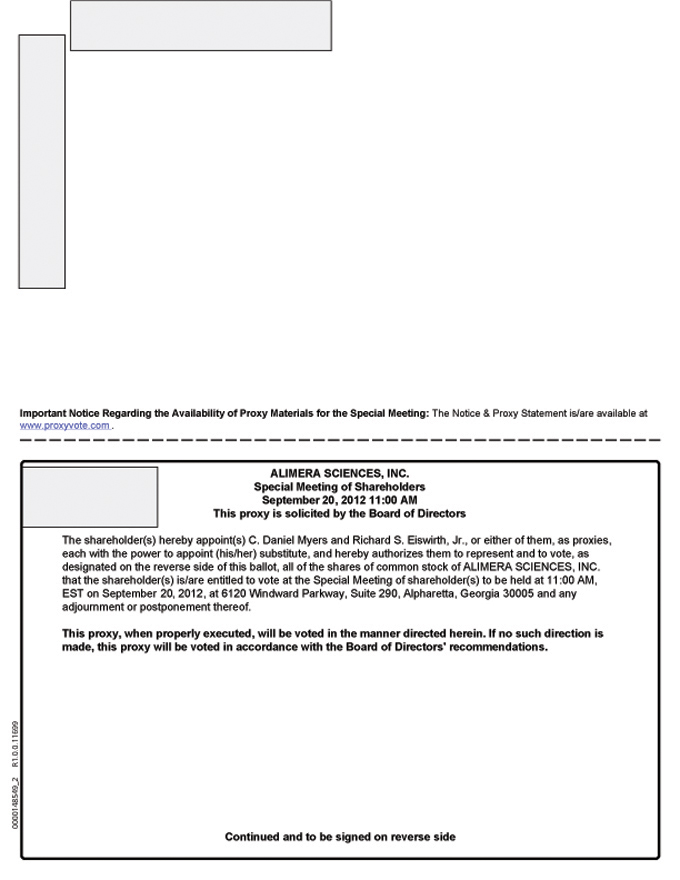

As previously announced, on July 17, 2012, we entered into a Securities Purchase Agreement (the “Purchase Agreement”) with a group of institutional investors, including both existing and new investors (the “Investors”) for the sale (the “Transaction”) of shares of the Company’s Series A Convertible Preferred Stock (the “Series A Preferred Stock”) and warrants (the “Warrants”) to purchase shares of the Company’s Series A Preferred Stock, which is expected to result in gross proceeds to the Company of $40,000,000. For each share of Series A Preferred Stock being purchased, the Investors will receive Warrants to purchase 0.30 shares of Series A Preferred Stock. The Transaction will provide critical capital necessary for us to commercialize our product, ILUVIEN®, in Europe on our own, which we believe will increase stockholder value.

In summary, pursuant to the Purchase Agreement, at the closing of the Transaction and upon the approval of our stockholders, we will sell 1,000,000 shares of the Company’s Series A Preferred Stock and the Warrants to purchase 300,000 shares of the Company’s Series A Preferred Stock, which will carry the right to be converted into approximately 36.24% of our common stock, par value $0.01 per share (our “Common Stock”), based on our current capitalization. Therefore, if the proposal in the attached proxy statement is approved, the Investors would have beneficial ownership of our Common Stock, assuming the conversion of all shares of Series A Preferred Stock and the exercise and subsequent conversion of all Warrants, of approximately 43.62% (including Common Stock already held by certain Investors) along with certain other rights.

The terms of this important financing require us to submit certain matters for stockholder approval in accordance with applicable NASDAQ listing rules. The proxy statement and proxy card accompanying this notice of special meeting describe in detail the Transaction and the matters to be acted upon at the meeting. We urge you to read these materials carefully. In summary, the purposepurposes of the meeting is:

are:

1. To elect three Class III directors (Proposal 1);

2. To ratify the appointment of Grant Thornton LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2013 (Proposal 2);

3. To approve,

on an advisory basis, the

issuancecompensation of

Series A Preferred Stock convertible into our

Common Stock under circumstances which require stockholder approval pursuant to applicable NASDAQ Listing Rules.There are no “dissenters”named executive officers (Proposal 3); and

4. To transact such other business as may properly come before the annual meeting or

“appraisal” rights available to our stockholders in connection with this proposal.any adjournments or postponements thereof.

Our board of directors has fixed the close of business on

August 10, 2012April 26, 2013 as the record date for determining holders of our

Common Stockcommon stock and preferred stock entitled to notice of, and to vote at, the

specialannual meeting or any adjournments or postponements thereof. A complete list of such stockholders will be available for examination at our offices in Alpharetta, Georgia during normal business hours for a period of ten days prior to the

specialannual meeting.

This year we are again using the Internet as our primary means of furnishing proxy materials to stockholders. Accordingly, most stockholders will not receive copies of our proxy materials. We instead are mailing a notice with instructions for accessing the proxy materials and voting via the Internet (the “Notice of Internet Availability”). We encourage you to review these materials and vote your shares. This delivery method allows us to conserve natural resources and reduce the cost of delivery while also meeting our obligations to you, our stockholders, to provide information relevant to your continued investment in the Company. If you received the Notice of Internet Availability by mail and would like to receive a printed copy of our proxy materials, you should follow the instructions for requesting such materials included in the Notice of Internet Availability.

This notice of

specialannual meeting of stockholders and accompanying proxy statement are being distributed or made available to stockholders on or about

August 27, 2012.April 29, 2013.

Important Notice Regarding the Availability of Proxy Materials for the Stockholders Meeting to be held on September 20, 2012:June 18, 2013: The proxy statement isand annual report are available atwww.proxyvote.com.

www.proxyvote.com. |

|

| By order of the Board of Directors, |

|

|

Secretary of the Company |

Date:

August 24, 2012April 29, 2013

Your vote is important. Please vote by using the Internet or by telephone or,

if you received a paper copy of the proxy card by mail, by signing and returning the enclosed proxy card. Instructions for your voting options are described

inon the

Notice of Internet Availability of Proxy Materials or proxy

statement.card.

For

a Specialthe Annual Meeting of Stockholders

To Be Held on

September 20, 2012June 18, 2013

Alpharetta, Georgia 30005

PROXY STATEMENT FOR THE SPECIAL

2013 ANNUAL MEETING

OF STOCKHOLDERS TO BE HELD ON SEPTEMBER 20, 2012

This proxy statement and proxy card are furnished in connection with the solicitation of proxies to be voted at the

special meeting2013 Annual Meeting of

stockholders to be held on September 20, 2012Stockholders (the

“Special“Annual Meeting”) of Alimera Sciences, Inc. (sometimes referred to as “we”, the “Company” or “Alimera”), which will be held at

our offices at 6120 Windward Parkway, Suite 290, Alpharetta, Georgia 30005,

on Tuesday, June 18, 2013 at

11:009:30 a.m.

local time.

We are making this proxy statement

and our annual report available to stockholders at www.proxyvote.com. On

August 27, 2012,April 29, 2013, we will begin mailing to our stockholders

(i) a notice (the “Notice”) containing instructions on how to access and review this proxy statement and our annual report or (ii) a copy of this proxy statement,

and a proxy

card.card and our annual report. The Notice also instructs you how you may submit your proxy over the Internet. If you received a Notice and would like to receive a printed copy of our proxy materials, you should follow the instructions for requesting those materials included in the Notice.

QUESTIONS AND ANSWERS ABOUT THIS PROXY MATERIAL AND VOTING

Why am I receiving

thisthese proxy

statement and proxy card?materials?

You have received these proxy materials because you owned shares of Alimera common stock

or Series A Convertible Preferred Stock (“Series A Preferred Stock”) as of

August 10, 2012,April 26, 2013, the record date for the

SpecialAnnual Meeting, and our board of directors is soliciting your proxy to vote at the

SpecialAnnual Meeting. This proxy statement describes matters on which we would like you to vote at the

SpecialAnnual Meeting. It also gives you information on these matters so that you can make an informed decision.

Why did I receive a Notice of Internet Availability of Proxy Materials in the mail instead of a printed set of proxy materials?

Pursuant to rules adopted by the Securities and Exchange Commission, we are permitted to furnish our proxy materials over the Internet to our stockholders by delivering a Notice in the mail. As a result, only stockholders that specifically request a printed copy of the proxy statement will receive one. Instead, the Notice instructs stockholders on how to access and review the proxy statement and annual report over the Internet at www.proxyvote.com. The Notice also instructs stockholders on how they may submit their proxy over the Internet or via phone. If a stockholder who received a Notice would like to receive a printed copy of our proxy materials, such stockholder should follow the instructions for requesting these materials contained in the Notice.

How may I vote at the

SpecialAnnual Meeting?

You are invited to attend the

SpecialAnnual Meeting to vote on the

proposalproposals described in this proxy statement. However, you do not need to attend the meeting to vote your shares. Instead, you may simply follow the instructions below to submit your proxy via telephone

or on the

InternetInternet. If you received or

requested a printed set of materials, you may also vote by mail by signing, dating and returning the proxy card.

When you vote by using the Internet or by telephone or by signing and returning the proxy card, you appoint C. Daniel Myers and Richard S. Eiswirth, Jr. as your representatives (or proxyholders) at the

SpecialAnnual Meeting. They will vote your shares at the

SpecialAnnual Meeting as you have instructed them or, if an issue that is not on the proxy card comes up for vote, in accordance with their best judgment. This way, your shares will be voted whether or not you attend the

SpecialAnnual Meeting.

Who is entitled to vote at the

SpecialAnnual Meeting?

Only stockholders of record at the close of business on

August 10, 2012,April 26, 2013, the record date for the

SpecialAnnual Meeting, will be entitled to vote at the

SpecialAnnual Meeting. On the record date, there were

31,432,44531,556,075 shares of the Company’s common stock

and 1,000,000 shares of the Company’s Series A Preferred Stock outstanding. All of these outstanding shares are entitled to vote at the

SpecialAnnual Meeting (one vote per share of common

stock)stock and one vote per share of common stock underlying the Series A Preferred Stock on an as-converted basis (based on a deemed conversion price of $2.95 per share) as of the record date) in connection with the matters set forth in this proxy statement.

In accordance with Delaware law, a list of stockholders entitled to vote at the meeting will be available at the place of the

Special Meetingannual meeting on

September 20, 2012June 18, 2013 and will be accessible for ten days prior to the meeting at our principal place of business, 6120 Windward Parkway, Suite 290, Alpharetta, Georgia 30005, between the hours of 9:00 a.m. and 5:00 p.m. local time.

If on

August 10, 2012,April 26, 2013, your shares were registered directly in your name with our transfer agent, American Stock Transfer & Trust Company, then you are a stockholder of record. Stockholders of record may vote by using the Internet, by telephone or

(if you received a proxy card by mail) by mail as described below. Stockholders also may attend the meeting and vote in person. If you hold shares through a bank or broker, please refer to your proxy card, Notice or other information forwarded by your bank or broker to see which voting options are available to you.

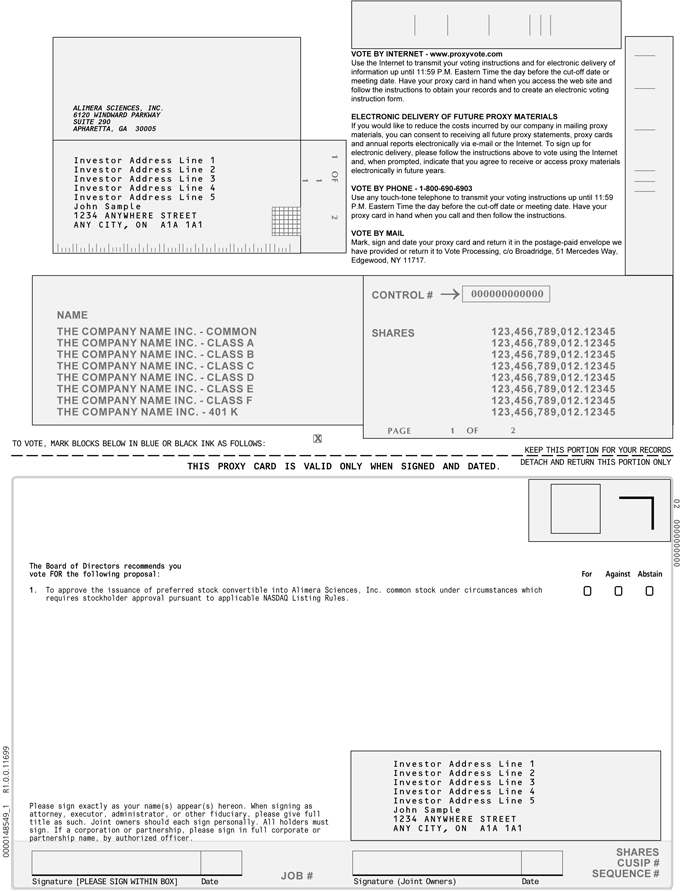

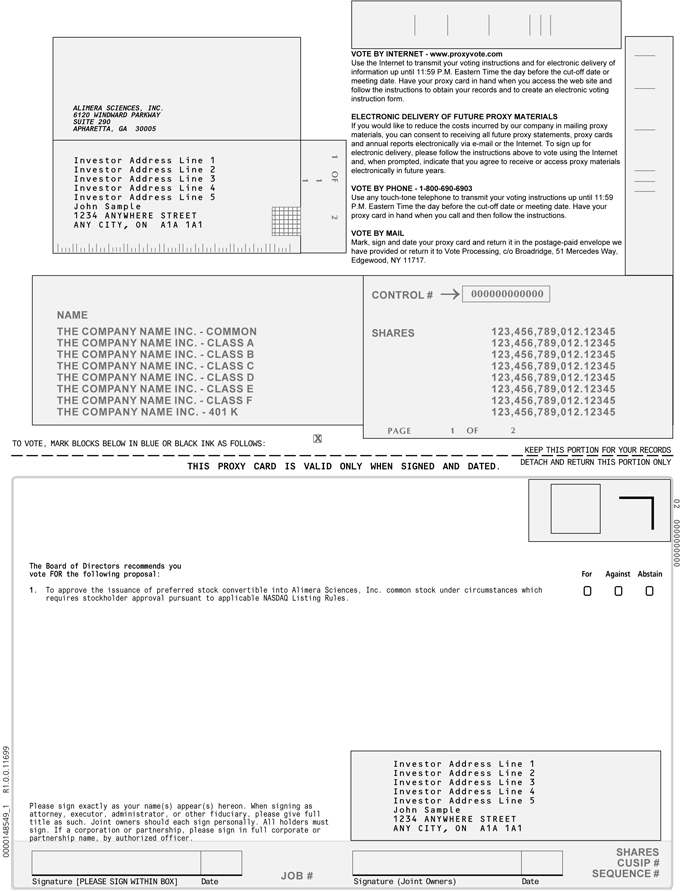

You may vote by using the Internet. The address of the website for Internet voting is www.proxyvote.com. Internet voting is available 24 hours a day and will be accessible until 11:59 p.m. Eastern Time on September 19, 2012. Easy-to-follow instructions allow you to vote your shares and confirm that your instructions have been properly recorded.

You may vote by telephone. The toll-free telephone number is noted on your proxy card. Telephone voting is available 24 hours a day and will be accessible until 11:59 p.m. Eastern Time on September 19, 2012. Easy-to-follow voice prompts allow you to vote your shares and confirm that your instructions have been properly recorded.

You may vote by mail. If you choose to vote by mail, simply mark your proxy card, date and sign it, and return it in the postage-paid envelope. Your proxy card must be received by the close of business on September 19, 2012.

|

| | |

| • | You may vote by using the Internet. The address of the website for Internet voting is www.proxyvote.com. Internet voting is available 24 hours a day and will be accessible until 11:59 p.m. Eastern Time on June 17, 2013. Easy-to-follow instructions allow you to vote your shares and confirm that your instructions have been properly recorded. |

|

| | |

| • | You may vote by telephone. The toll-free telephone number is noted on your proxy card. Telephone voting is available 24 hours a day and will be accessible until 11:59 p.m. Eastern Time on June 17, 2013. Easy-to-follow voice prompts allow you to vote your shares and confirm that your instructions have been properly recorded. |

|

| | |

| • | You may vote by mail. If you received a proxy card by mail and choose to vote by mail, simply mark your proxy card, date and sign it, and return it in the postage-paid envelope. Your proxy card must be received by the close of business on June 17, 2013. |

The method you use to vote will not limit your right to vote at the

SpecialAnnual Meeting if you decide to attend in person. Written ballots will be passed out to anyone who wants to vote at the

SpecialAnnual Meeting. If you hold your shares in “street name,” you must obtain a proxy, executed in your favor, from the holder of record to be able to vote in person at the

SpecialAnnual Meeting.

Can I change my vote after submitting my proxy?

Yes. You can revoke your proxy at any time before the final vote at the

SpecialAnnual Meeting. If you are the record holder of your shares, you may revoke your proxy in any one of three ways:

You may submit a subsequent proxy by using the Internet, by telephone or by mail with a later date;

You may deliver a written notice that you are revoking your proxy to the Secretary of the Company at 6120 Windward Parkway, Suite 290, Alpharetta, Georgia 30005; or

You may attend the Special Meeting and vote your shares in person. Simply attending the Special Meeting without affirmatively voting will not, by itself, revoke your proxy.

|

| | |

| • | You may submit a subsequent proxy by using the Internet, by telephone or by mail with a later date; |

|

| | |

| • | You may deliver a written notice that you are revoking your proxy to the Secretary of the Company at 6120 Windward Parkway, Suite 290, Alpharetta, Georgia 30005; or |

|

| | |

| • | You may attend the Annual Meeting and vote your shares in person. Simply attending the Annual Meeting without affirmatively voting will not, by itself, revoke your proxy. |

If you are a beneficial owner of your shares, you must contact the broker or other nominee holding your shares and follow their instructions for changing your vote.

How many votes do you need to hold the

SpecialAnnual Meeting?

A quorum of stockholders is necessary to conduct business at the

SpecialAnnual Meeting. Pursuant to our

amended and restated bylaws, a quorum will be present if a majority of the voting power of outstanding shares of the Company entitled to vote generally

in the election of directors is represented in person or by proxy at the

SpecialAnnual Meeting. On the record date, there were

31,432,44531,556,075 shares of common stock outstanding and entitled to

vote and 13,559,322 shares of common stock underlying the outstanding Series A Preferred Stock (based on a deemed conversion price of $2.95 per share) entitled to vote. Thus,

15,716,22322,557,699 shares must be represented by stockholders present at the

SpecialAnnual Meeting or represented by proxy to have a quorum.

The holders of the common stock and the Series A Preferred Stock (on an as converted basis based on a deemed conversion price of $2.95 per share) vote together as a single class for the proposals in this proxy statement.

Your shares will be counted towards the quorum only if you submit a valid proxy (or one is submitted on your behalf by your broker, bank or other nominee) or if you attend the

SpecialAnnual Meeting and vote in person. Abstentions and broker non-votes will be counted for the purpose of determining whether a quorum is present for the transaction of business. If a quorum is not present, the

chairman of the meeting or holders of a majority of the votes present at the

SpecialAnnual Meeting may adjourn the

SpecialAnnual Meeting to another date.

What matters will be voted on at the

SpecialAnnual Meeting?

The following

matter ismatters are scheduled to be voted on at the

SpecialAnnual Meeting:

|

| | |

| | • | | Proposal: ApprovalProposal 1: To elect three Class III directors nominated by our board of the issuance of preferred stock convertible into our common stock under circumstances which require stockholder approval pursuant to applicable NASDAQ Listing Rules, as describeddirectors and named in this proxy statement.statement to serve a term of three years until our 2016 annual meeting of stockholders;

|

|

| | |

| • | Proposal 2: To ratify the appointment of Grant Thornton LLP as our independent registered public accountants for the year ending December 31, 2013; and |

|

| | |

| • | Proposal 3: To approve, on an advisory basis, the compensation of our named executive officers. |

No cumulative voting rights are authorized, and dissenters’ rights are not applicable to these matters.

Could other matters be decided at the

SpecialAnnual Meeting?

Alimera does not know of any other matters that may be presented for action at the

SpecialAnnual Meeting. Should any other matter be properly presented at the

SpecialAnnual Meeting, the persons named on the proxy card will have discretionary authority to vote the shares represented by proxies in accordance with their best judgment. If you hold shares through a broker, bank or other nominee as described above, they will not be able to vote your shares on any other business that comes before the

SpecialAnnual Meeting unless they receive instructions from you with respect to such other business.

What will happen if I do not vote my shares?

Stockholder of Record: Shares Registered in Your Name. If you are the stockholder of record of your shares and you do not vote by proxy card, by telephone, via the Internet or in person at the SpecialAnnual Meeting, your shares will not be voted at the SpecialAnnual Meeting. Beneficial Owner: Shares Registered in the Name of Broker or Bank. Brokers or other nominees who hold shares of our common stock or preferred stock for a beneficial owner have the discretion to vote on routine proposals when they have not received voting instructions from the beneficial owner at least ten days prior to the SpecialAnnual Meeting. A “broker non-vote”broker non-vote occurs when a broker or other nominee does not receive voting instructions from the beneficial owner and does not have the discretion to direct the voting of the shares. Under the rules that govern brokers who are voting shares held in street name, brokers have the discretion to vote those shares on routine matters but not on non-routine matters. The proposalProposal 2 is a non-routine matter.the only routine matter in this proxy statement. As such, your broker does not have discretion to vote your shares on the proposal.Proposals 1 or 3. We encourage you to provide instructions to your bank or brokerage firm by voting your proxy. This action ensures your shares will be voted at the meeting in accordance with your wishes.

How may I vote for theeach proposal and what is the vote required for each proposal?

Proposal 1: Election of three Class III directors.

With respect to the proposal?election of nominees for director, you may:

|

| | |

| • | vote “FOR” the election of the three nominees for director; |

|

| | |

| • | “WITHHOLD” your vote for one or two of the nominees and vote “FOR” the remaining nominee(s); or |

|

| | |

| • | “WITHHOLD” your vote for the three nominees. |

Directors will be elected by a plurality of the votes cast at the Annual Meeting, meaning the three nominees who are properly nominated in accordance with our amended and restated bylaws, and receive the most “FOR” votes will be elected. Only votes cast “FOR” a nominee will be counted. An instruction to “WITHHOLD” authority to vote for one or more of the nominees will result in those nominees receiving fewer votes, but will not count as a vote against the nominees. Abstentions and broker non-votes will have no effect on the outcome of the election of directors. Because the election of directors is not a matter on which a broker or other nominee is generally empowered to vote, broker non-votes are expected to exist in connection with this matter.

Proposal 2: Ratification of the appointment of Grant Thornton LLP as our independent registered public accountants for the year ending December 31, 2013.

You may vote“FOR” or“AGAINST” or abstain from voting. To approveratify the issuanceselection by the audit committee of preferred stock convertible into our common stock under circumstances which require stockholder approval pursuant to applicable NASDAQ Listing Rules,board of directors of Grant Thornton LLP as described in this proxy statement,the independent registered public accounting firm of the Company for the year ending December 31, 2013, the Company must receive a“FOR” vote from a majority of all those outstanding shares that are present in person, or represented by proxy, and that are cast either affirmatively or negatively on the proposal at the SpecialAnnual Meeting. Abstentions and “broker non-votes”broker non-votes will not be counted“FOR” or“AGAINST” the proposal and will have no effect on the proposal. Because the approvalratification of the issuanceappointment of preferred stock convertible into our common stock under circumstances requiring stockholder approval pursuantthe independent registered public accounting firm is a matter on which a broker or other nominee is generally empowered to applicable NASDAQ Listing Rulesvote, no broker non-votes are expected to exist in connection with this matter.

Proposal 3: Advisory vote on executive compensation.

You may vote “FOR” or “AGAINST” or abstain from voting. To approve, by non-binding vote, the compensation of the Company’s named executive officers as set forth in this proxy, the Company must receive a “FOR” vote from a majority of all those outstanding shares that are present in person, or represented by proxy, and that are cast either affirmatively or negatively on the proposal at the Annual Meeting. Abstentions and broker non-votes will not be counted “FOR” or “AGAINST” the proposal and will have no effect on the proposal. Because Proposal 3 is a non-routine matter, broker non-votes are expected to exist in connection with this matter. What happens if a director nominee is unable to stand for election?

If a nominee is unable to stand for election, our board of directors may either:

|

| | |

| • | reduce the number of directors that serve on the board or |

|

| | |

| • | designate a substitute nominee. |

If our board of directors designates a substitute nominee, shares represented by proxies voted for the nominee who is unable to stand for election will be voted for the substitute nominee.

How does

ourthe board of directors recommend that I vote?

Our board recommends a

vote“FOR” the approval of the issuance of preferred stock convertible into our common stock under circumstances which requires stockholder approval pursuant to NASDAQ Listing Rules.vote:

|

| | |

| • | Proposal 1: “FOR” the election of each of Mark J. Brooks, Brian K. Halak, Ph.D. and Peter J. Pizzo, III as Class III directors to serve a term of three years until our 2016 annual meeting of stockholders; |

|

| | |

| • | Proposal 2: “FOR” the ratification of the appointment of Grant Thornton LLP as the independent registered public accounting firm of the Company for the year ending December 31, 2013; and |

|

| | |

| • | Proposal 3: “FOR” the approval, in an advisory manner, of the compensation of our named executive officers as set forth in this proxy statement. |

What happens if I sign and return my proxy card but do not provide voting instructions?

If you return a signed and dated proxy card without marking any voting selections, your shares will be

voted“FOR” the approval of the issuance of preferred stock convertible into our common stock under circumstances which requires stockholder approval pursuant to applicable NASDAQ Listing Rules.voted:

|

| | |

| • | Proposal 1: “FOR” the election of each of Mark J. Brooks, Brian K. Halak, Ph.D. and Peter J. Pizzo, III as Class III directors; |

|

| | |

| • | Proposal 2: “FOR” the ratification of the appointment of Grant Thornton LLP as our independent registered public accounting firm for the year ending December 31, 2013; and |

|

| | |

| • | Proposal 3: “FOR” the approval, in an advisory manner, of the compensation of our named executive officers as set forth in this proxy statement. |

If any other matter is properly presented at the

SpecialAnnual Meeting, the proxyholders for shares voted on the proxy card (i.e. one of the individuals named as proxies on your proxy card) will vote your shares using his or her best judgment.

What do I need to show to attend the

SpecialAnnual Meeting in person?

You will need proof of your share ownership (such as a recent brokerage statement or letter from your broker showing that you owned shares of

ourAlimera Sciences, Inc. common

stock or preferred stock as of

August 10, 2012)April 26, 2013) and a form of photo identification. If you do not have proof of ownership and valid photo identification, you may not be admitted to the

SpecialAnnual Meeting. All bags, briefcases and packages will be held at registration and will not be allowed in the meeting. We will not permit the use of cameras (including cell phones with photographic capabilities) and other recording devices in the meeting room.

Who is paying for this proxy solicitation?

We will pay for the entire cost of soliciting proxies. We may reimburse brokerage firms, banks and other agents for the cost of forwarding proxy materials to beneficial owners.

The accompanying proxy is being solicited by the board of directors of the Company. In addition to this solicitation, directors and employees of the Company may solicit proxies in person, by telephone, or by other means of communication. Directors and employees will not be paid any additional compensation for soliciting proxies. In addition, the Company may also retain one or more third parties to aid in the solicitation of brokers, banks and institutional and other stockholders.

We will pay for the entire cost of soliciting proxies. We may reimburse brokerage firms, banks and other agents for the cost of forwarding proxy materials to beneficial owners.

What happens if the

SpecialAnnual Meeting is postponed or adjourned?

Unless the polls have closed or you have revoked your proxy, your proxy will still be in effect and may be voted once the

SpecialAnnual Meeting is reconvened. However, you will still be able to change or revoke your proxy with respect to any proposal until the polls have closed for voting on such proposal.

How can I find out the results of the voting at the

SpecialAnnual Meeting?

Preliminary voting results are expected to be announced at the

SpecialAnnual Meeting. Final voting results will be reported on a Current Report on Form 8-K filed with the SEC no later than

September 26, 2012.June 24, 2013.

How can I find Alimera’s proxy materials

and annual report on the Internet?

This proxy statement

isand the 2012 annual report are available at our corporate website at www.alimerasciences.com. You also can obtain

a copycopies without charge at the SEC’s website at www.sec.gov. Additionally, in accordance with SEC rules, you may access these materials at www.proxyvote.com, which does not have “cookies” that identify visitors to the site.

How do I obtain a separate set of Alimera’s proxy materials if I share an address with other stockholders?

In some cases, stockholders holding their shares in a brokerage or bank account who share the same surname and address and have not given contrary instructions

receivedreceive only one copy of the

proxy materials.Notice. This practice is designed to reduce duplicate mailings and save printing and postage costs as well as natural resources. If you would like to have a separate copy of the

Notice or our annual report and/or proxy statement mailed to you or to receive separate copies of future mailings, please submit your request to the address or phone number that appears on your

Notice or proxy card. We will deliver such additional copies promptly upon receipt of such request.

In other cases, stockholders receiving multiple copies of the

proxy materialsNotice at the same address may wish to receive only one. If you would like to receive only one copy if you now receive more than one, please submit your request to the address or phone number that appears on your

Notice or proxy card.

Can I receive future proxy materials

and annual reports electronically?

Yes. This proxy statement

isand the 2012 annual report are available on our investor relations website located at http://investor.alimerasciences.com. Instead of receiving paper copies in the mail, stockholders can elect to receive an email that provides a link to our future

annual reports and proxy materials on the Internet. Opting to receive your proxy materials electronically will save us the cost of producing and mailing documents to your home or business, will reduce the environmental impact of our

annual meetings and will give you an automatic link to the proxy voting site.

Whom should I call if I have any questions?

If you have any questions, would like additional Alimera proxy materials or proxy cards, or need assistance in voting your shares, please contact Investor Relations, Alimera Sciences, Inc., 6120 Windward Parkway, Suite 290, Alpharetta, Georgia 30005 or by telephone at (310) 954-1105.

Can I submit a proposal for inclusion in the proxy statement for the

20132014 annual meeting?

Stockholders of the Company may submit proper proposals (other than the nomination of directors) for inclusion in our proxy statement and for consideration at our 20132014 annual meeting of stockholders by submitting their proposals in writing to the Secretary of the Company in a timely manner. In order to be considered for inclusion in our proxy materials for the 20132014 annual meeting of stockholders, stockholder proposals must:be received by the Secretary of the Company no later than the close of business on December 31, 2012; and

otherwise comply with the requirements of Delaware law, Rule 14a-8 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and our bylaws.

|

| | |

| • | be received by the Secretary of the Company no later than the close of business on December 30, 2013 (which is the 120th day prior to the first anniversary of the date that we released this proxy statement to our stockholders for the Annual Meeting); and |

|

| | |

| • | otherwise comply with the requirements of Delaware law, Rule 14a-8 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and our amended and restated bylaws. |

Unless we receive notice in the foregoing manner, the proxy holdersproxyholders shall have discretionary authority to vote for or against any such proposal presented at our 20132014 annual meeting of stockholders. If we change the date of the 2014 annual meeting of stockholders by more than 30 days from the anniversary of this year’s Annual Meeting, stockholder proposals must be received a reasonable time before we begin to print and mail our proxy materials for the 2014 annual meeting of stockholders.

Can I submit a nomination for director candidates and proposals not intended for inclusion in the proxy statement for the 2014 annual meeting?

Stockholders of the Company who wish to nominate persons for election to the board of directors at the 2014 annual meeting of stockholders or who wish to present a proposal at the 2014 annual meeting of stockholders, but who do not intend for such proposal to be included in our proxy materials for such meeting, must deliver written notice of the nomination or proposal to Alimera Sciences, Inc., 6120 Windward Parkway, Suite 290, Alpharetta, Georgia 30005, Attention: Secretary no earlier than February 13, 2014 and no later than March 15, 2014. However, if the 2014 annual meeting of stockholders is held earlier than May 19, 2014 or later than July 18, 2014, nominations and proposals must be received no later than the close of business on the later of (a) the 90th day prior to the 2014 annual meeting of stockholders and (b) the 10th day following the day we first publicly announce the date of the 2014 annual meeting. In addition, if the number of directors to be elected to the board of directors is increased and we do not publicly announce all of the nominees for election or specify the size of the increase by March 15, 2014, then proposals with respect to nominees for any new positions created by the increase in board size must be delivered to the address listed above no later than the 10th day following such public announcement. The stockholder’s written notice must include certain information concerning the stockholder and each nominee and proposal, as specified in our amended and restated bylaws.

Where can I obtain a copy of the Company’s amended and restated bylaws?

A copy of our

amended and restated bylaw provisions governing the notice requirements set forth above may be obtained by writing to the Secretary of the Company. A current copy of our

amended and restated bylaws also is available at our corporate website at www.alimerasciences.com. Such requests and all notices of proposals and director nominations by stockholders should be sent to Alimera Sciences, Inc., 6120 Windward Parkway, Suite 290, Alpharetta, Georgia 30005, Attention:

Secretary of the Company.Secretary.

Important Notice Regarding the Availability of Proxy Materials

for the Meeting to be Held on

September 20, 2012Tuesday, June 18, 2013

This proxy statement isand our annual report are available on-line atwww.proxyvote.com.

BACKGROUND

MATTERS TO BE CONSIDERED AT THE ANNUAL MEETING

PROPOSAL 1: ELECTION OF DIRECTORS

General

Our board of directors is currently comprised of nine (9) directors divided into three equal classes with staggered three-year terms. The term of office of our Class III directors, Brian K. Halak, Ph.D., Mark J. Brooks and Peter J. Pizzo, III, will expire at this year’s Annual Meeting. The term of office of our Class I directors, C. Daniel Myers, Calvin W. Roberts, M.D. and James R. Largent, will expire at the 2014 annual meeting of stockholders. The term of office of our Class II directors, Philip R. Tracy, Glen Bradley, Ph.D. and Garheng Kong, M.D., Ph.D., will expire at the 2015 annual meeting of stockholders. There are no family relationships among any of our directors or executive officers. It is our policy to encourage nominees for director to attend the Annual Meeting.

Nominees for Election as Class III Directors at the Annual Meeting

This year’s nominees for election to the board of directors as our Class III directors to serve for a term of three years expiring at the 2016 annual meeting of stockholders, or until their successors have been duly elected and qualified or until their earlier death, resignation or removal, are provided below. The age of each director as of April 26, 2013 is set forth below. Each of the nominees has agreed to serve as a director if elected, and we have no reason to believe that either nominee will be unable to serve if elected.

|

| | | | | | | | |

| Name | | Age | | Positions and Offices Held with Company | | Director Since | |

| Mark J. Brooks | | 46 | | Director | | 2004 | |

| Brian K. Halak, Ph.D. | | 41 | | Director | | 2004 | |

| Peter J. Pizzo, III | | 46 | | Director | | 2010 | |

The following is additional information about each of the nominees as of the date of this proxy statement, including their business experience, director positions held currently or at any time during the last five years, involvement in certain legal or administrative proceedings, if applicable, and the experiences, qualifications, attributes or skills that caused the nominating/corporate governance committee and our board of directors to determine that the nominees should serve as one of our directors.

Mark J. Brooks has been a member of our board of directors since 2004. Since its formation in January 2007, Mr. Brooks has served as a Managing Director of Scale Venture Partners. Prior to joining Scale Venture Partners, from 1995 Mr. Brooks worked for Bank of America Ventures, ultimately serving as a Managing Director. Mr. Brooks also serves on the Board of Directors of IPC The Hospitalist Company, Inc., a publicly traded provider of hospitalist services, and also serves on the Board of four privately held companies: National Healing Corporation, LivHome, Inc., Spinal Kinetics, Inc. and Oraya Therapeutics, Inc. Mr. Brooks holds an M.B.A. from the Wharton School at the University of Pennsylvania and a B.A. in Economics from Dartmouth College. Our board of directors believes that Mr. Brooks should serve as a director of the Company, in light of its business and structure, because in addition to his valuable contributions to our Company in recent years, Mr. Brooks has experience as one of the directors of Scale Venture Partners, where Mr. Brooks led investments in healthcare services, medical devices and drug development and his service on the board of directors of a number of Scale Venture Partners’ portfolio companies.

Brian K. Halak, Ph.D. has been a member of our board of directors since 2004. Dr. Halak joined Domain Associates, L.L.C. in 2001 and has served as a Partner of Domain Associates, L.L.C. since 2006. Prior to joining Domain Associates, L.L.C., Dr. Halak served as an analyst of Advanced Technology Ventures from 2000 to 2001. From 1993 to 1995, Dr. Halak has served as an analyst of Wilkerson Group. Dr. Halak holds a Doctorate in Immunology from Thomas Jefferson University and a B.S. in Engineering from the University of Pennsylvania. Our board of directors believes that Dr. Halak should serve as a director of the Company, in light of its business and structure, because in addition to his valuable contributions to our Company in recent years, Dr. Halak has served on the board of directors of more than 10 emerging companies in the life sciences industry in the past 10 years, including Vanda Pharmaceuticals, which completed a public offering on Nasdaq, and Esprit Pharma, a company that was acquired by Allergan.

Peter J. Pizzo, III has been a member of our board of directors since April 2010. Since its formation in 2005, Mr. Pizzo has served as the Vice President, Finance and Chief Financial Officer of Carticept Medical, Inc., a private orthopedic medical device company, which he co-founded. From 2002 until its sale in 2005, Mr. Pizzo served as the Vice President, Finance and Chief Financial Officer of Proxima Therapeutics, Inc., a private medical device company that developed and marketed local radiation delivery systems for the treatment of solid cancerous tumors. From 1996 to 2001, Mr. Pizzo worked for Serologicals Corporation, a publicly traded global provider of biological products to life science companies, ultimately serving as Vice President of Finance and Chief Financial Officer. From 1995 to 1996, Mr. Pizzo served as Vice President of Administration and Controller of ValueMark Healthcare Systems, Inc., a privately held owner-operator of psychiatric hospitals. From 1992 until its sale in 1995, Mr. Pizzo served in various senior financial positions at Hallmark Healthcare Corporation, a publicly traded hospital management company, most recently as Treasurer. Mr. Pizzo holds a Bachelor of Science with Special Attainments in Commerce from Washington and Lee University. Our board of directors believes that Mr. Pizzo should serve as a director of the Company, in light of its business and structure, because Mr. Pizzo has over 19 years of experience in medical devices, biologics and healthcare services, including the past 13 years in the role of vice president, finance and chief financial officer.

Required Vote and Recommendation of the Board of Directors for Proposal 1

The affirmative vote of a plurality of the votes cast at the Annual Meeting is required for the election of our Class III directors. The three nominees receiving the most “FOR” votes among votes properly cast in person or by proxy will be elected to the board as Class III directors. You may vote “FOR” or “WITHHOLD” on each of the nominees for election as director. Shares represented by signed proxy cards will be voted on Proposal 1 “FOR” the election of Mr. Brooks, Dr. Halak and Mr. Pizzo to the board of directors at the Annual Meeting, unless otherwise marked on the card. A broker non-vote or a properly executed proxy marked “WITHHOLD” with respect to the election of a Class III director will not be voted with respect to such director, although it will be counted for purposes of determining whether there is a quorum.

OUR BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT YOU

VOTE “FOR” MARK J. BROOKS, BRIAN K. HALAK, PH.D. AND

OVERVIEWPETER J. PIZZO, III

SaleContinuing Directors Not Standing for Election

Certain information about those directors whose terms do not expire at the Annual Meeting is furnished below, including their business experience, director positions held currently or at any time during the last five years, involvement in certain legal or administrative proceedings, if applicable, and the experiences, qualifications, attributes or skills that caused the nominating/corporate governance committee and our board of directors to determine that the directors should serve as one of our directors. The age of each director as of April 26, 2013 is set forth below.

|

| | | | | | | | |

| Name | | Age | | Positions and Offices Held with Company | | Director Since | |

| C. Daniel Myers | | 59 | | Director, President and Chief Executive Officer | | 2003 | |

| Calvin W. Roberts, M.D. | | 60 | | Director | | 2003 | |

| Philip R. Tracy | | 71 | | Chairman of the Board of Directors | | 2004 | |

| Glen Bradley, Ph.D. | | 70 | | Director | | 2011 | |

| James R. Largent | | 63 | | Director | | 2011 | |

| Garheng Kong, M.D., Ph.D. | | 37 | | Director | | 2012 | |

Class I Directors (Terms Expire in 2014)

C. Daniel Myers is one of our co-founders and has served as our Chief Executive Officer and as a director since the founding of our Company in 2003. Before founding our Company, Mr. Myers was an initial employee of Novartis Ophthalmics (formerly CIBA Vision Ophthalmics) and served as its Vice President of Sales and Marketing from 1991 to 1997 and as President from 1997 to 2003. Mr. Myers holds a B.S. in Industrial Management from Georgia Institute of Technology. Our board of directors believes that Mr. Myers should serve as a director of the Company, in light of its business and structure, because in addition to his valuable contributions to our Company in recent years, Mr. Myers has over 30 years of ophthalmic pharmaceutical experience, including 15 years in the role of president or chief executive officer. In addition, Mr. Myers served on the board of directors of Ocular Therapeutix, Inc. from 2009 to 2012.

Calvin W. Roberts, M.D. has been a member of our board of directors since 2003. Dr. Roberts currently serves as an Executive Vice President and the Chief Medical Officer of Bausch + Lomb. Since 1982, Dr. Roberts has served as a Clinical Professor of Ophthalmology at Weill Medical College of Cornell University. From 1989 to 2011, Dr. Roberts also served as a consultant to Allergan, Inc., Johnson & Johnson and Novartis. Dr. Roberts holds an A.B. from Princeton University and an M.D. from the College of Physicians and Surgeons of Columbia University. Dr. Roberts completed his internship and ophthalmology residency at Columbia Presbyterian Hospital in New York and completed cornea fellowships at Massachusetts Eye and Ear Infirmary and the Schepens Eye Research Institute in Boston. Our board of directors believes that Dr. Roberts should serve as a director of the Company, in light of its business and structure, because in addition to his valuable contributions to our Company in recent years, Dr. Roberts has an understanding of the market for products in ophthalmology and the nature of the relationship between pharmaceutical companies and physicians derived from his 25 years in the practice of medicine as well as his experience in the medical market place and in the processes of drug development and regulatory approval as a consultant to other pharmaceutical companies.

James R. Largent has been a member of our board of directors since 2011. Mr. Largent has worked extensively within the medical industry. He most recently served as a medical and pharmaceutical consultant, including work with U.S. ophthalmic device company, Eyeonics Inc. While there, he led the lobbying effort that resulted in the 2005 landmark decision by the Centers for Medicare & Medicaid Services (CMS) to allow for patient shared billing for premium presbyopia-correcting intraocular lenses. Also in his role as a consultant, he assisted a multinational pharmaceutical and medical device company in the evaluation of strategic targets. Prior to this, Mr. Largent served in various senior management positions at Allergan, Inc., including as vice president of strategic planning where he fostered licensing deals to build product pipelines. Earlier in his career, he was vice president of strategic marketing at Allergan Medical Optics, Inc. Mr. Largent also held positions of increasing responsibility in the marketing and sales departments at Allergan and Pharmacia Ophthalmics. In addition to serving on Alimera’s Board, Mr. Largent is on the board of directors of Tear Science, Inc., a privately held developer of diagnostic and therapeutic devices

for the treatment of patients with dry eye disease. Mr. Largent earned a B.A. in chemistry and an M.B.A., both from the University of California, Irvine. Our board of directors believes that Mr. Largent should serve as a director of the Company, in light of its business and structure, because Mr. Largent has over 10 years of experience in pharmaceutical and medical devices, including the role of vice president of strategic marketing and as a leading industry consultant.

Class II Directors (Terms Expire in 2015)

Philip R. Tracy has been a member of our board of directors since 2004. Since 1998, Mr. Tracy has served as a Venture Partner of Intersouth Partners. He is also counsel to the Raleigh, North Carolina law firm Smith, Anderson, Blount, Dorsett, Mitchell & Jernigan, L.L.P. Previously, Mr. Tracy was employed by Burroughs Wellcome Co. from 1974 to 1995 and served as President and Chief Executive Officer from 1989 to 1995. Mr. Tracy holds an L.L.B. from George Washington University and a B.A. from the University of Nebraska. Our board of directors believes that Mr. Tracy should serve as a director of the Company, in light of its business and structure, because in addition to his valuable contributions to our Company in recent years, Mr. Tracy has served on the board of directors of three publicly traded companies in the biotechnology and pharmaceutical industries, has experience as president and chief executive officer of Burroughs Wellcome Co. with full responsibility for its North American pharmaceutical business, has legal training and experience as a lawyer including his service as general counsel to Burroughs Wellcome Co., and has 15 years of experience in the venture capital industry as a venture partner with Intersouth Partners.

Glen Bradley, Ph.D., M.B.A., has been a member of our board of directors since 2011. Dr. Bradley served as the Chief Executive Officer of CIBA Vision Corporation, the eye care unit of Novartis, A.G., or CIBA Vision, from 1990 to January 2003. Since 2003, Dr. Bradley has acted as a consultant to various medical device and ophthalmic drug companies. Dr. Bradley served in the positions of President and CEO from 1986 to 1989 for CIBA Vision, the United States operations of the CIBA Vision Group. Prior to CIBA Vision, he served in senior management positions in the Agricultural, Plastics & Additives and Electronic Equipment Groups of CIBA-Geigy Corporation. Dr. Bradley has been Chairman of the Board of Directors at REFOCUS Group Inc., since March 2003. He serves as a Director of Intuity Medical, Inc. He has previously held board positions with Spectra Physics, Summit Technology, Biofisica, AerovectRx, e-Dr and Biocure. He served as Chairman of the Contact Lens Institute. Dr. Bradley holds a bachelor’s degree in chemical engineering from Mississippi State University, a Ph.D. in chemical engineering from Louisiana State University, an MBA in business and finance from the University of Connecticut and is a graduate of the Advanced Management Program at Harvard Business School. Our board of directors believes that Dr. Bradley should serve as a director of the Company, in light of its business and structure, because of his significant knowledge, experience, and financial expertise in the ophthalmic industry.

Garheng Kong, M.D., Ph.D., has been a member of our board of directors since 2012. Dr. Kong has served as a General Partner at Sofinnova, a venture firm focused on life sciences, since 2010. From 2000 to 2010, he was at Intersouth Partners, a venture capital firm, most recently as a General Partner, where he was a founding investor or board member for various life sciences ventures, several of which were acquired by large pharmaceutical companies. Dr. Kong has served on the board of directors of Cempra, Inc. since September 2006 and as chairman of its board since November 2008. Dr. Kong has served on the board of directors of SARcode BioScience, Inc., a private biopharmaceutical company, since 2011 and on the board of Histogenics Corporation, a private biotechnology company, since 2012 where he also serves as the chairman of the board. Dr. Kong holds a B.S. in chemical engineering and biological sciences from Stanford University. He holds an M.D., Ph.D. in biomedical engineering and M.B.A. from Duke University. Our board of directors believes that Dr. Kong should serve as a director of the Company, in light of its business and structure, because of his knowledge and experience in the venture capital industry, as well as his medical training.

CORPORATE GOVERNANCE

Series A Preferred

StockDirector

On

July 17,October 2, 2012, we entered into a Securities Purchase Agreement

(the “Purchase Agreement”) with a group of institutional investors, including both existing and new investors (the “Investors”) for the sale

(the “Transaction”)of an aggregate of 1,000,000 units comprised of 1,000,000 shares of

a newly created series of preferred stock, designated “Series A Convertible Preferred Stock,” par value $0.01 per share (the “Series A Preferred Stock”) and warrants (the “Warrants”) to purchase 300,000 shares of the Series A Preferred Stock. For each share of Series A Preferred Stock being purchased, the Investors will receive a Warrant to purchase 0.30 shares of Series A Preferred Stock. The Series A Preferred Stock is convertible into authorized but unissued shares of our

common stock, par value $0.01 per share (the “Common Stock”).The closing of the Transaction is subject to customary closing conditions, including, but not limited to, the approval of the Transaction by the majority of the votes cast on the proposal, either in person or by proxy, as required under the applicable regulations of the NASDAQ stock market, at a special meeting of the stockholders of the Company.

For each unit consisting of a share of Series A Preferred Stock and a Warrant, the Investors have agreedWarrants exercisable for up to pay a negotiated pricean aggregate of $40.00 (the “Original Purchase Price”), which is expected to result in gross proceeds to the Company300,000 shares of $40,000,000, before deducting expenses payable by the Company. We expect to use substantially all of the proceeds from the Transaction to fund the commercialization of ILUVIEN® in Germany, the United Kingdom and France. Upon approval of the proposal described herein and the closing of the Transaction, the Investors’ ownership of our Common Stock, assuming the conversion of all shares of Series A Preferred Stock and theat an exercise and subsequent conversion of all Warrants, will represent approximately 43.62% of all outstanding shares of Common Stock.

Rationale for the Proposed Transaction

In considering whether to approve the Transaction, our Board of Directors considered the timing and extent of our needs for additional capital and alternative transactions for raising such capital. The Board of Directors determined that the Transaction is in the best interest of us and our stockholders because, among other reasons:

| • | | The proceeds from the Transaction will allow us to commercialize our product, ILUVIEN®, in Germany, the United Kingdom and France on our own;

|

The initial conversion price of the Series A Preferred Stock, $2.91, was based on the average closing price$44.00 per share for gross proceeds of our Common Stock over the 30 trading-days period preceding the date of the Purchase Agreement, rather than a discount$40.0 million prior to our trading price;

A public transaction to raise capital would typically involve file-to-offer discounts to our trading price;

The Transaction does not require the payment of any investment advisor fees, underwriters’ discounts or commissions, as typically would be involved in a public transaction; and

The Transaction will enhance our capital base and provide additional certainty for the Company’s planning and operations.

Securities Purchase Agreement

The following discussion of the Purchase Agreement provides only a summary of the material terms and conditions of the Purchase Agreement, and is qualified by reference to the Purchase Agreement attached as Exhibit A hereto.

The Purchase Agreement contains representations and warranties by us relating to, among other things, our corporate organization and capitalization, the due authorization of the Purchase Agreement and the shares to be issued, the lack of required governmental consents, litigation, intellectual property, compliance with other instruments, our filings with the SEC, including the financial statements included therein, internal controls, absence of certain events and changes, lack of undisclosed liabilities, our charter documents and registration rights.

The Purchase Agreement also contains representations and warranties by the Investors relating to, among other things, each Investor’s investment intent.

Until the earlier of the closing of the Transaction or the termination of the Purchase Agreement, we have agreed to conduct our business in the ordinary course of business consistent with past practices, and, without the prior written consent of Investors purchasing at least seventy percent (70%) of the Series A Preferred Stock pursuant to the Purchase Agreement (the “Investor Approval”), we have agreed not to redeem or repurchase any shares of any capital stock of the Company or other equity security or declare or pay any dividend or other distribution with respect to our common stock; split, combine or reclassify any shares of our capital stock or issue, sell or transfer any shares of any capital stock of the Company or other equity securities or the issuance or incurrence of any additional indebtedness outside of the ordinary course of business other than issuances pursuant to the Company’s equity incentive plans or Permitted Indebtedness (as defined below); undertake any material change our accounting methods or principles, except as required by a change in GAAP or as required by law; or dispose of any property or assets of the Company other than in the ordinary course of business. Also, prior to stockholder approval of the Transaction, without the Investor Approval, we have agreed not to pursue or agree to an alternative financing to the Transaction.

The closing of the Transaction is subject to certain conditions, including the approval of the Transaction by our stockholders, and other customary closing conditions.

The Purchase Agreement automatically terminates if the closing of the Transaction has not occurred on or before November 30, 2012; provided, however, that we and any Investor, with respectrelated expenses. Pursuant to such Investor, may, by mutual written agreement extend the term of the Purchase Agreement beyond November 30, 2012.

Stockholders are not third-party beneficiaries under the Purchase Agreement and should not construe the representations, warranties and covenants or any descriptions thereof as characterizations of the actual state of facts or conditions of us, the Investors or any of the Investors’ subsidiaries or affiliates. Moreover, information concerning the subject matter of the representations and warranties may change after the date of the Purchase Agreement, which subsequent information may or may not be fully reflected in our public disclosures.

Terms of the Series A Convertible Preferred Stock

The powers, preferences, rights, qualifications, limitations and restrictions applicable to the Series A Preferred Stock are set forth in the Certificate of Designation of Series A Convertible Preferred Stock (the “Certificate of Designation”), to be filed in connection with the Secretary of State of the State of Delaware prior to the closing of the Transaction.

Each share of Series A Preferred Stock is convertible into Common Stock at any time at the option of the holder at the rate (the “Conversion Rate”) equal to the Original Purchase Price divided by the then current conversion price (the “Conversion Price”). The initial Conversion Price will be $2.91 and shall be subject to standard broad-based weighted average anti-dilution adjustments prior to the date on which the Company has received and publicly announces the approval by the U.S. Food and Drug Administration of the Company’s New Drug Application for ILUVIEN® (the “FDA Approval Date”), provided, that in no event shall the Conversion Price be adjusted below $1.00 (as adjusted for stock dividends, splits, combinations and similar events). Both the Original Purchase Price and the Conversion Price are subject to adjustments for stock dividends, splits, combinations and similar events. Each share of Series A Preferred Stock shall automatically be converted into Common Stock at the then applicable Conversion Rate upon the occurrence of the later to occur of both (i) the FDA Approval Date and (ii) the date on which Company consummates an equity financing transaction pursuant to which it sells to one or more third party investors either (A) Common Stock or (B) other equity securities that are convertible into Common Stock and that have rights, preference or privileges, senior to or on a parity with, the Series A Preferred Stock, in each case having an as-converted per share of Common Stock price of not less than $10.00 (adjusted for stock splits, combinations, stock dividends, recapitalizations and the like) and that results in total gross proceeds to the Company of at least $30,000,000. The Series A Preferred Stock is not redeemable and shall not be convertible at the option of the Company, other than as set forth above.

The holders of Series A Preferred Stock will be entitled to receive dividends and other distributions on a pari passu basis with the holders of Common Stock on an as-converted basis. Except as otherwise set forth in the Certificate of Designation, the Series A Preferred Stock will vote together with the Common Stock on a converted basis as described therein.

In the event of a Liquidation Transaction, as defined below, holderssale of the Series A Preferred Stock, will receive a payment equal to the greater of (a) one (1) times the Original Purchase Price (as adjusted for stock dividends, splits, combinations and similar events), plus any declared and unpaid dividends, per share of Series A Preferred Stock before any proceeds are distributed to the holders of Common Stock and (ii) the amount each holder of a share of Series A Preferred Stock would be entitled to receive had all shares of Series A Preferred Stock been converted into shares of Common Stock at the then applicable Conversion Price immediately prior to such Liquidation Transaction. Unless waived by the holders of at least 70% of the Series A Preferred Stock, voting together as a separate class, the following shall be deemed to constitute a Liquidation Transaction: (A) any acquisition of the Company by means of merger, consolidation, stock sale, tender offer, exchange offer or other form of corporate reorganization in which outstanding shares of the Company are exchanged or sold, in one transaction or a series of related transactions, for cash, securities, property or other consideration issued, or caused to be issued, by the acquiring entity or its subsidiary, or any other person or group of affiliated persons and in which the holders of capital stock of the Company hold less than a majority of the voting power of the surviving entity and (B) any sale, transfer, exclusive license or lease of all or substantially all of the properties or assets of the Company and its subsidiaries (each of such transactions in clause (A) and (B), together with an actual liquidation, dissolution or winding up of the Company, a “Liquidation Transaction”), provided that none of the following shall be deemed to constitute a Liquidation Transaction: (x) a transaction for which the sole purpose is to change the state of the Company’s incorporation, (y) a transaction for which the sole purpose is to create a holding company that will hold no assets other than shares of the Company and that will have securities with rights, preferences, privileges and restrictions substantially similar to those of the Company and that are owned in substantially the same proportions by the persons who held such securities of the Company, in each case immediately prior to such transaction or (z) a license transaction entered into by the Company for the purpose of developing and/or commercializing one or more of the Company’s products, so long as such license transaction would not be reasonably considered to be a sale or license of all or substantially all of the assets of the Company.

In addition, for so long as at least 37.5% of the shares of Series A Preferred Stock originally issued to the Investors at the closing of the Transactioncertain conditions are held by the initial Investors or their affiliates, the Company shall not, without first obtaining the Investor Approval: (i) increase or decrease the authorized number of shares of Series A Preferred Stock; (ii) authorize, create, issue or obligate itself to issue (by reclassification, merger or otherwise) any security (or any class or series thereof) or any indebtedness, in each case that has any rights, preferences or privileges senior to, or on a parity with, the Series A Preferred Stock, or any security convertible into or exercisable for any such security or indebtedness (other than the issuance of (A) up to an aggregate of $35,000,000 of indebtedness pursuant to the Company’s credit facility with Silicon Valley Bank and/or MidCap Financial, as the same may be amended, refinanced or resyndicated from time to time or (B) up to an aggregate of $500,000 of indebtedness pursuant to operating, capital or equipment leases entered into in the ordinary course of business (such indebtedness being the “Permitted Indebtedness”),; (iii) amend the Company’s certificate of incorporation (including by filing any new certificate of designation or elimination) or the Certificate of Designation, in each case in a manner that adversely affects the rights, preference or privileges of the Series A Preferred Stock; (iv) redeem, purchase or otherwise acquire (or pay into or set aside for a sinking fund for such purpose) any shares of Common Stock or Preferred Stock; provided, however, that this restriction shall not apply to (A) the redemption of rights issued pursuant to any “poison pill” rights plan or similar plan adopted by the Company after the closing of the Transaction or (B) the repurchases of stock from former employees, officers, directors or consultants who performed services for the Company in connection with the cessation of such employment or service pursuant to the terms of existing agreements with such individuals; (v) declare or pay any dividend or distribution on any shares of capital stock; provided, however, that this restriction shall not apply to (A) dividends payable to holders of Common Stock that consist solely of shares of Common Stock for which adjustment to the Conversion Price of the Series A Preferred Stock is made pursuant to the Certificate of Designation or (B) dividends or distributions issued pro rata to all holders of capital stock (on an as-converted basis) in connection with the implementation of a “poison pill” rights plan or similar plan by the Company; (vi) authorize or approve any increase to the number of aggregate shares of capital stock reserved for issuance pursuant to stock option, stock purchase plans or other equity incentive plans of the Company such that the total aggregate number of shares issued under such plans and reserved for issuance under such plans (on an as-converted basis) exceeds the number of shares issued and reserved for issuance under such plans (on an as-converted basis) on the date of the closing of the Transaction by more than 20% (adjusted for stock splits, combinations, stock dividends, recapitalizations and the like), provided that any increases resulting solely from the annual increases resulting from the “evergreen” provisions of the Company’s equity incentive plans in effect on the date of the closing of the Transaction shall not be subject to this restriction and shall not be included for purposes of determining whether such 20% increase has occurred; (vii) issue stock or other equity securities of any subsidiary of the Company (other than to the Company or another wholly-owned subsidiary of the Company) or declare or pay any dividend or other distribution of cash, shares or other assets or redemption or repurchase of shares of any subsidiary of the Company; or (viii) incur any secured indebtedness other than any Permitted Indebtedness.

A copy of the complete Certificate of Designation of the Series A Preferred Stock is attached as Exhibit B to this proxy statement.

Terms of the Warrants

The per share exercise price of the Warrants is $44.00. The Warrants will be exercisable beginning on the original date of issuance and will expire on the earlier of (i) immediately following the consummation of a Sale Event (for cash or freely tradable securities), if the Warrants are not exercised at or prior to consummation of the Sale Event or (ii) the date that is five (5) years after the closing of the Transaction. At the election of the holders of the Warrants, the Warrants may be exercised for the number of shares of Common Stock then issuable upon conversion of the Series A Preferred Stock that would otherwise be issued upon such exercise.

A copy of the complete form of Warrant is attached as Exhibit C to this proxy statement.

Registration of the Underlying Common Stock

Pursuant to the Purchase Agreement, the Company and the Investors, Palo Alto Investors, LLC (“PAI”), Sofinnova Venture Partners VIII, L.P. (“Sofinnova”) and Growth Equity Opportunities Fund III, LLC (“Growth Equity”), will enter into a Registration Rights Agreement (the “Registration Rights Agreement”), whereby the Company will be required to file on or before the date that is 45 days from the closing of the Transaction an “evergreen” shelf registration statement pursuant to the Securities Act to register the shares of Common Stock issuable upon conversion of the Series A Preferred Stock issued and sold in the Transaction to PAI, Sofinnova and Growth Equity (the “Conversion Shares”), and the shares of Common Stock issuable upon exercise of the Warrants or issuable upon conversion of the Series A Preferred Stock issuable upon exercise of the Warrants issued to PAI, Sofinnova and Growth Equity (the “Warrant Shares,” and together with the Conversion Shares, the “Registrable Securities”) for resale. The Registration Rights Agreement also contains provisions for “demand registration rights,” pursuant to which the Investors may require the Company to register or all or a portion of their Registrable Securities and offer them for resale in an underwritten offering, and “piggyback registration rights” pursuant to which the Investors may include their Registrable Securities in any future registration statement filed by the Company, with certain exceptions as set forth in the Registration Rights Agreement. In addition, the Company agreed to use reasonable best efforts to keep the registration, and any qualification, exemption or compliance under state securities laws which the Company determines to obtain, continuously effective, and to keep the registration statement and any related prospectuses or prospectus supplement free of any material misstatements or omissions, until the date on which the Company shall have obtained a written opinion of legal counsel reasonably satisfactory to the Investors and addressed to the Company and the Investors to the effect that the Registrable Securities may be publicly offered for sale in the United States by the Investors or any subsidiary of such Investor without restriction as to manner of sale and amount of securities sold and without registration or other restriction under the Securities Act. The following discussion of the Registration Rights Agreement provides only a summary of the material terms and conditions of the Registration Rights Agreement, and is qualified by reference to the Registration Rights Agreement attached as Exhibit D hereto.

Demand Registration Rights

Under the Registration Rights Agreement, after March 1, 2013 and prior to the date on which the Company shall have a obtained a written opinion of legal counsel reasonably satisfactory to the Investors and addressed to the Company and the Investors to the effect that the Registrable Securities may be publicly offered for sale in the United States by the Investors or any subsidiary of such Investor without restriction as to manner of sale and amount of securities sold and without registration or other restriction under the Securities Act, each of PAI and Sofinnova have the right to require that we register all or a portion of their Registrable Securities. We are only obligated to effect one registration for each of PAI and Sofinnova in response to these demand registration rights. We may postpone the filing of a registration statement for up to 90 days once in any 12-month period if our Board of Directors determined in good faith that the filing would be seriously detrimental to our stockholders or to us. The underwriters of any underwritten offering have the right to limit the number of shares to be included in a registration statement filed in response to the exercise of these demand registration rights. We must pay all expenses, except for underwriters’ discounts and commissions, incurred in connection with these demand registration rights.

Piggyback Registration Rights

If we register any securities for public sale, under the Registration Rights Agreement, the Investors have the right to include their shares in the registration, subject to specified exceptions. The underwriters of any underwritten offering have the right to limit the number of shares registered by the Investors due to marketing reasons. We must pay all expenses, except for underwriters’ discounts and commissions incurred in connection with these piggyback registration rights.

Stockholder Support Letters

In connection with the Transaction, stockholders holding approximately 56% of the Company’s Common Stock as of July 17, 2012, have entered into separate agreements with us whereby they have agreed to vote all of the shares of our Common Stock beneficially owned by them as of the record date of the Special Meeting in favor of the Transaction, and have granted an irrevocable proxy to us to vote such shares of Common Stock in favor of the Transaction. As a result, we expect that the proposal will be approved at the Special Meeting.

Investor Representation on the Company’s Board of Directors

Pursuant to the Purchase Agreement, conditioned on the closing of the Transaction, the Company agreed to increase the number of directors on the Company’s Board of Directors from eight (8) directors to nine (9) directors. Pursuant to the Certificate of Designation, for as long as Sofinnova, together with its affiliates, continues to hold at least 50% of the shares of Series A Preferred Stock originally issued to Sofinnova at the closing under the Purchase Agreement (or shares of Common Stock issued upon conversion thereof),met, the holders of Series A Preferred Stock, voting as singlea separate class, shall beare entitled to elect, at any election of the Company’sour Class II Directors, one individualdirector to serve as a Class II Directoron the board of directors (the “Series A“Preferred Director”), who shall be designated by Sofinnova. The initial Series A Director will be appointed. For so long as of the closing of the Transaction and is currently expected to be Garheng Kong. At the closing of the Transaction, the Series A Director will also enter into an indemnification agreement requiring the Company to indemnify him to the fullest extent permitted under Delaware law with respect to his or her service as a director. The indemnification agreement will be in the form entered into with the Company’s other directors and executive officers. This form is filed as Exhibit 10.1 to the Company’s Registration Statement on Form S-1, as amended (File No. 333-162782), which was declared effective by the Securities and Exchange Commission (the “SEC”) on April 21, 2010.

Amendment to Our Bylaws

In connection with the Transaction, on July 16, 2012, the Board of Directors approved an amendment to the Amended and Restated Bylaws of the Company, which amendment shall be effective upon and subject to the closing of the Transaction, to provide that the holders of Series A Preferred Stock may take any exclusive action required or permitted to be taken by the stockholders holding Series A Preferred Stock pursuant to the Certificate of Designation by written consent at any time.

NASDAQ Listing Rules